More About Frost Pllc

Table of ContentsWhat Does Frost Pllc Do?The Greatest Guide To Frost PllcSome Known Details About Frost Pllc What Does Frost Pllc Mean?All about Frost Pllc

Today, people analytics are incorporated right into numerous HRMS. They help Humans resources identify trends, such as attrition, involvement, and performance levels, and take restorative actions.

Smaller sized organizations have actually flatter styles for faster decision-making and flexible operations. There are numerous legal frameworks. The sole proprietorship is perfect for solo experts starting out. Collaborations offer common ownership and responsibilities. Whereas, a limited responsibility firm incorporates liability security with the flexibility of a collaboration. An extra complicated structure entails an S firm, better fit for bigger companies.

What Does Frost Pllc Do?

But commonly, companions or proprietors rest on top, creating techniques and objectives. Then come directors and supervisors that lead different divisions, like audit or taxes. The execs under them include team accountants who specialize in special areas of bookkeeping. Assistance functions like HR, advertising and marketing, sales, and IT might develop parallel pecking orders.

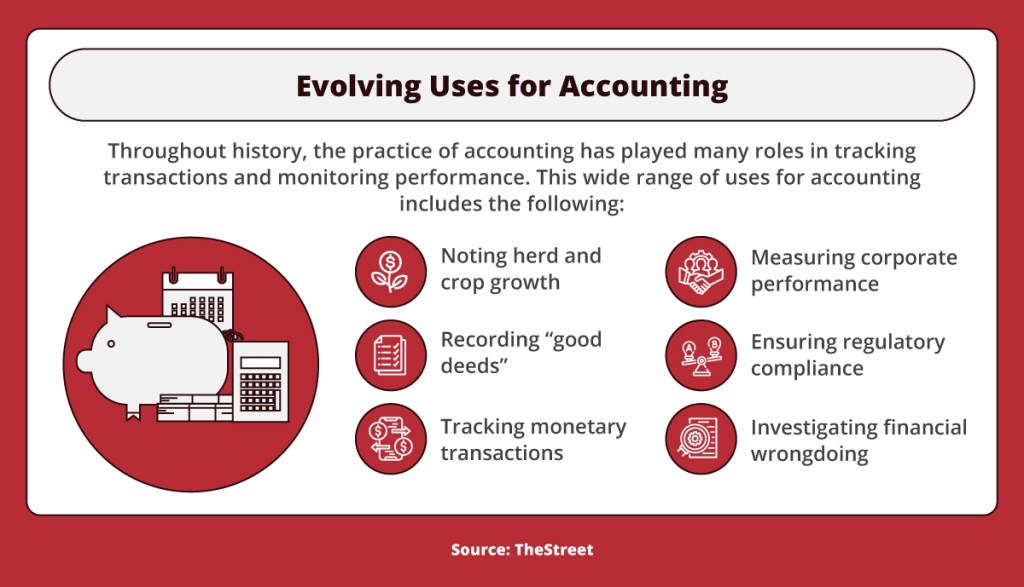

Accountancy is business language. It offers essential info about cash matters and success of an entity. It also measures, deals with and interacts economic information to various parties. By examining financial records, accounting assists with decision-making, preparation and complying with the law. It demonstrates how profitable and reputable a company is, and helps with future growth.

Accountability is additionally made certain by bookkeeping. It guarantees funds are made use of properly and allocated appropriately. With audit practices, stakeholders can objectively examine a business's financial setting. A fascinating story makes evident the relevance of audit. In 1929, during the Wall Road Crash, accounting flaws and lack of openness resulted in a recession.

Instance of accounting: The example of audit can be seen with a detailed table that demonstrates the economic purchases and declarations of a business. By abiding to these concepts, individuals and services can guarantee accurate accounting, exposure, and smart decision-making. They offer an usual language for money pros, allowing them to chat effectively with stakeholders and translate accountancy data carefully.

This makes certain economic declarations demonstrate a service's real my response monetary scenario at any type of moment. This states that as soon as an audit approach has been selected, it ought to be constantly used in all financial reporting periods.

Furthermore, the concept of materiality emphasizes that only distinct details ought to be included in economic statements. This indicates unimportant products need to be stayed clear of to stay clear of confusion and enhance quality. Comprehending these basic accountancy principles is essential for everyone in financing, such as accounting professionals, investors, and entrepreneur. Adhering to these principles warranties moral techniques and develops count on amongst stakeholders.

Record Purchases: Get all monetary activities properly and in a time-sensitive means, making certain each purchase Find Out More is designated to its corresponding account. Hold Ledgers: Have specific journals for each account, permitting for exact monitoring and research of purchases. Resolve Accounts: Routinely comparison videotaped transactions with bank declarations or other outside sources to identify any type of incongruities.

Frost Pllc - Truths

To make certain financial statements are accurate and significant, adhere to these ideas: Regular Accounting Plans: Make Use Of the very same policies over various periods for easier contrast. Exact Record-keeping: Keep track of all transactions for dependable and credible statements. Normal Settlement: Routine settlements to recognize disparities and keep equilibrium sheet numbers. Independent Bookkeeping: Hire independent auditors to have an objective assessment of the statements.

It additionally assists companies gauge their monetary security, analyze productivity and strategy for the future. Accounting is a language of company. It records and records financial transactions properly, permitting stakeholders to examine firm performance and position.

In addition, bookkeeping permits various divisions within an organization to interact effectively. Reliable accounting techniques guarantee conformity and provide information to recognize growth chances and protect against risks.

With audit, it can track sales profits, deduct the price of items marketed, and allot expenses such as rent and incomes. Frost PLLC. This evaluation assists identify one of the most rewarding items and notifies check out this site future buying and advertising strategies. Bookkeeping plays a number of vital roles in service, including financial record-keeping, preparing economic declarations, budgeting, tax obligation conformity, and inner control execution

The smart Trick of Frost Pllc That Nobody is Discussing